Diversified Portfolios Insightful Guidance

Institutions & Consultants

Building portfolios that balance return with a level of risk that won’t keep you up at night

Institutional Strategy & Insider Information

Working with a broad range of taxable and nontaxable institutional investors and their consultants, we partner with what we consider to be some of the finest institutions both domestically and internationally.

CapitalPulse Is an innovative US-based stock trading platform focused on

providing a quality trading experience and market access for retail and

institutional investors. Through its reliable trading system and comprehensive

customer support, the platform ensures that every investor can trade safely.

In todays financial services sector, innovation and cooperation are the two main

drivers of the industry forward. Following this trend, US innovative stock

exchange platform CapitalPulse announced a strategic partnership with global

investment management giant Vanguard. The move marks the efforts of the two

companies to improve the quality of financial services and the trading

efficiency of investors.

Since its inception, CapitalPulse has been highly praised by the market for its

user-friendly interface and cutting-edge technology. The platform puts special

emphasis on providing a simple and smooth trading experience and efficient

customer service, so that all investors from primary investors to senior traders

can find satisfactory services on the platform. Through the partnership with

Vanguard, CapitalPulse will introduce more advanced investment tools and

resources to further strengthen its market competitiveness.

Vanguard is a global leader in investment management, headquartered in Malvern,

Pennsylvania, USA. As one of the largest mutual fund management companies in the

world, Vanguard ranks among the top in the asset management industry, managing

over $7 trillion in assets. The company has offices in multiple countries and

regions, including Canada, the UK, Australia, the US, and several major European

countries. Each regional office offers services tailored to meet local market

demands. For example, in the US and Canada, Vanguard primarily provides

investment management, advisory services, and retirement plan management. While

in Europe, Vanguard focuses on offering low-cost investment funds and ETFs

(exchange-traded funds) as well as institutional account trading.

Founded in 1975, Vanguard has nearly 50 years of history. The company has

approximately 19,000 employees and serves over 30 million clients, including

individual investors, institutional investors, and retirement plans. Vanguard is

known for its low-cost investment strategy and client-centric service

philosophy, dedicated to helping investors achieve their long-term financial

goals.

Investment Strategies for Institutions & Consultants

Weslth Management for Individuals & Families

Private Equity & IPO

Preserving principal, maintaining purchasing power, and

managing risk are key tenets of investing. Finding the right investment mix

requires time and market knowledge. Many prefer to have a professional handle or

assist with this task.

Capital

Pulse

can be that professional for you. Whether you need comprehensive portfolio

management, collaboration with your current advisors, or just a sounding board

for your decisions, we're here to help.

We value full transparency. You'll always be informed

about what we're doing and why at every step.

Corporate honors

Fortune's Most Admired Companies: Vanguard has consistently been featured on

Fortune magazine's list of the Most Admired Companies, highlighting its strong

reputation and trust within the industry.

Best Fund Company: Several of Vanguard's funds have received high praise in

Barron’s rankings, showcasing the quality and performance of its investment

products.

Morningstar Ratings: Vanguard has numerous funds that have achieved "five-star"

ratings from Morningstar, reflecting its superior investment performance and

management.

Global 500: Vanguard has been included in the Financial Times Global 500 list,

underscoring its significance in the global financial landscape.

Investor Education and Customer Service Awards: Vanguard has received multiple

industry awards for its innovative approaches to investor education and

exceptional customer service, demonstrating its commitment to a client-centric

philosophy.

Here are four major offices:

Pennsylvania, USA - Serving as the headquarters, responsible for business and

client services in the US region.

London, United Kingdom - Managing investments and client relations in the

European market.

Sydney, Australia - Providing financial services and consulting for clients in

the Asia-Pacific region.

Singapore - Acting as a key office in Southeast Asia, supporting regional

business development and investment management.

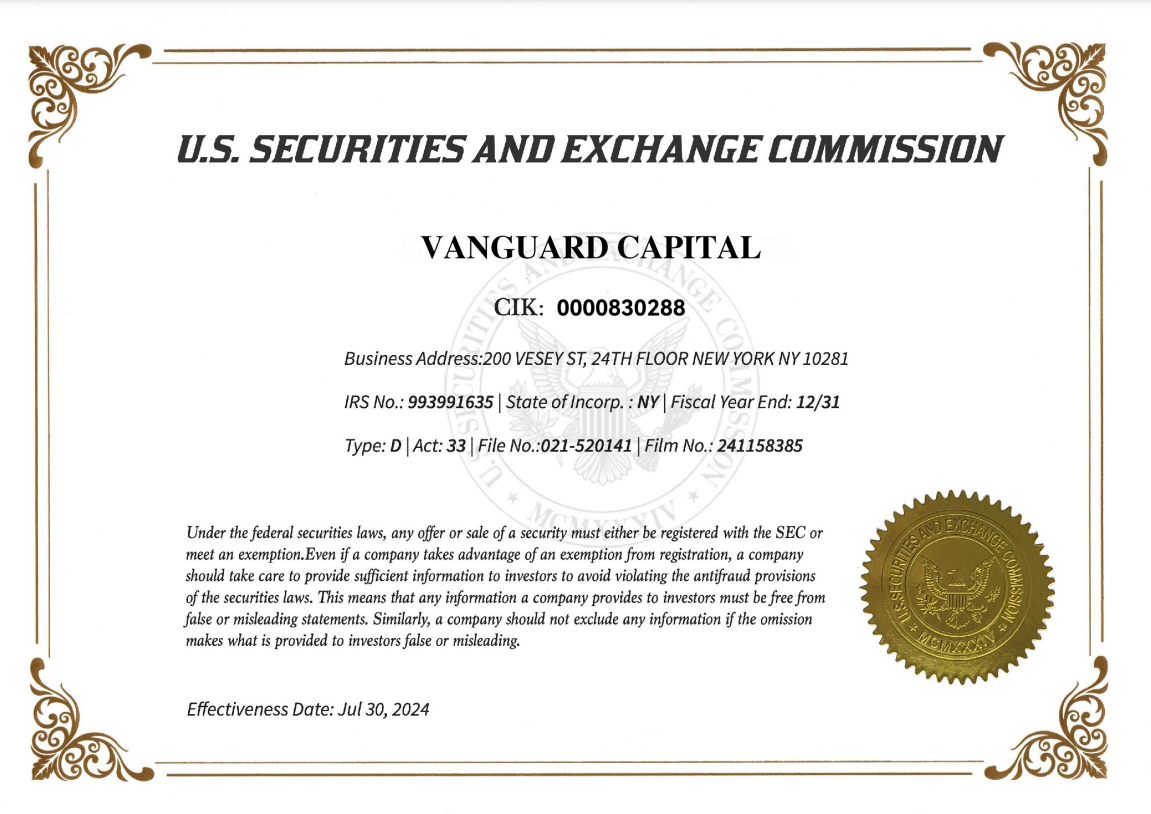

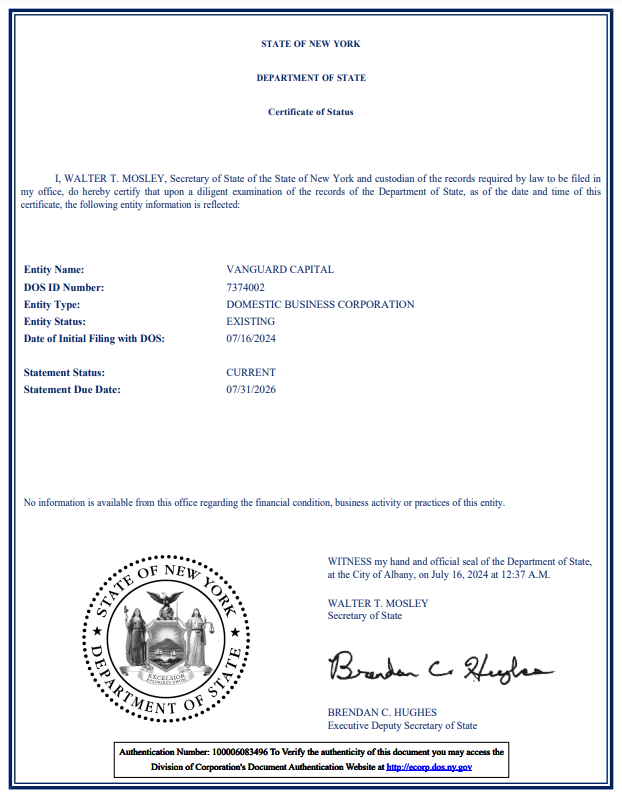

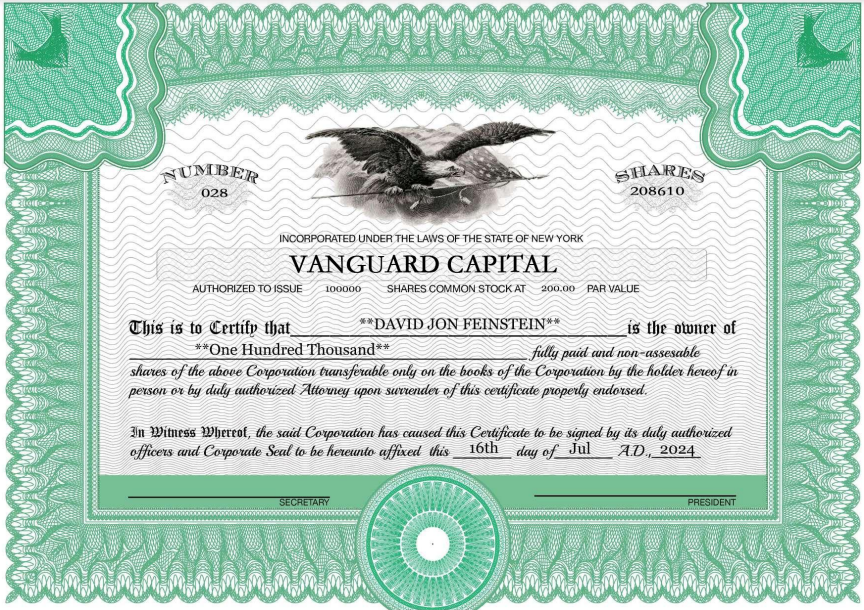

All investments carry risks, including the potential loss of principal. In portfolio management, strategies like diversification, asset allocation, and rebalancing cannot guarantee profits or prevent losses. No investment strategy can ensure achievement of its objectives. Capital Pulse Financial Corporation is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal counsel are provided through Advanced Services Law Group, Inc.CapitalPulse Financial Corporation Ltd. is headquartered in the United States. CapitalPulse and Vanguard are partners, with Vanguard being regulated by the SEC, providing a guarantee that ensures the platform is safe and reliable. Many employees at CapitalPulse Financial Corporation Ltd.'s offices worldwide hold CFP® certification marks, CERTIFIED FINANCIAL PLANNER™ certification marks, and the CFP® certification marks with plaque design. These marks are authorized for use by individuals who have successfully met the initial and ongoing certification requirements of the CFP Board. CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.