Our institutional client base is

extensive, encompassing investment companies, collective investment vehicles,

retirement plans, charitable organizations, government entities, insurance

companies, and businesses across various sectors. For individual clients, we

offer a wide array of services including goal-based financial planning,

investment management, insurance planning, trust and estate planning, tax

planning, philanthropic donation planning, risk management, and executive

compensation planning, specifically catering to high-net-worth individuals.

In serving our institutional

clients, we cover a broad spectrum of asset management areas such as public and

private equity, cash and short duration fixed income, investment-grade fixed

income, asset-liability management, leveraged credit, multi-sector fixed income,

private placements, private debt, midstream energy, and securitized credit. Our

client base includes a wide range of entities like insurance companies,

foundations, religious groups, non-profits, public employee retirement systems,

Taft-Hartley entities, and corporations across various industries.

At Capital Pulse, our advisory

team

holds highly professional certifications such as Chartered Financial Analyst

(CFA), Certified Financial Planner (CFP), Chartered Alternative Investment

Analyst (CAIA), and Certified Investment Management Analyst (CIMA). These

qualifications have contributed significantly to our substantial growth over the

past two decades.

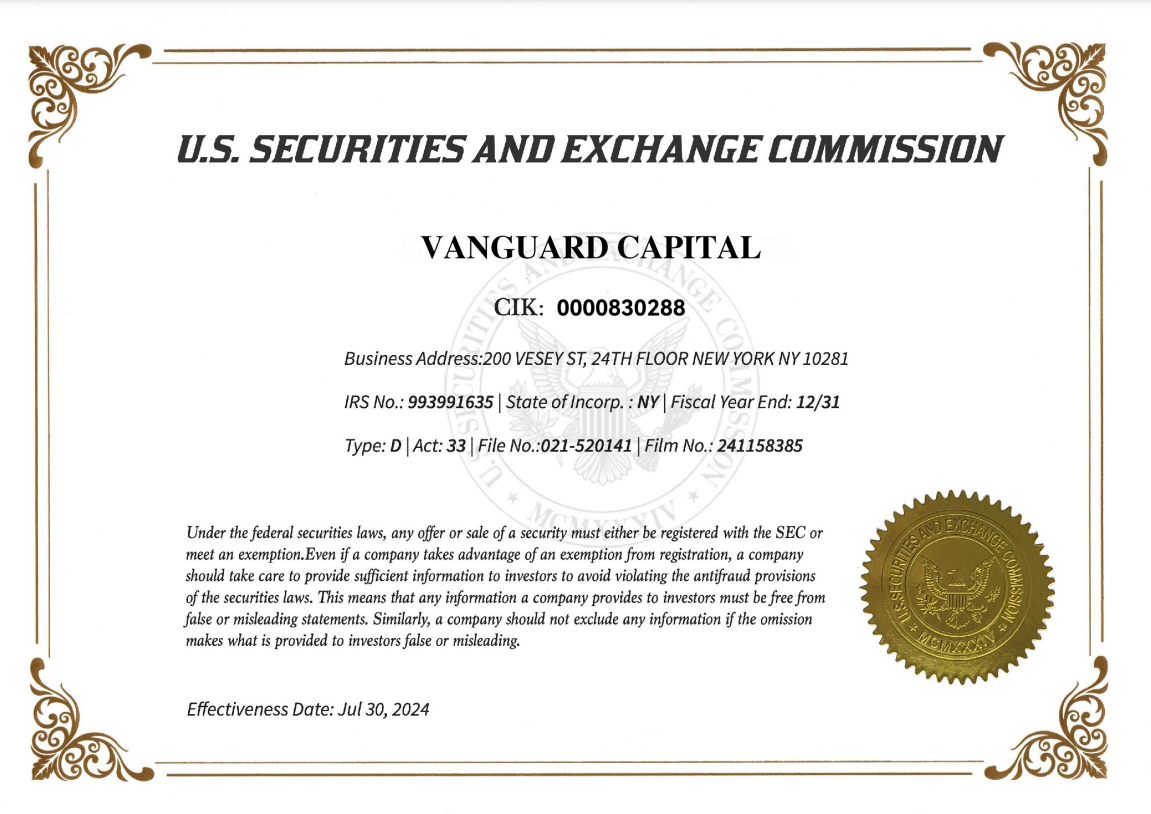

As a registered SEC investment advisor, as of September 30, 2023, we manage an impressive portfolio totaling $74.3 billion. Our commitment to applying well-defined investment values across our diverse range of strategies has solidified our leadership position in the investment advisory industry.

Capital Pulse At a Glance

Registered Investment Advisor since 2003

Capital Pulse Financial Corporation operates globally, with service points in several countries, including: United States (where the headquarters are located)、Hong Kong、Singapore、Canada、Japan、India、Malaysia、United Kingdom

United Nations-supported Principles for Responsible Investment (UNPRI) signatory since 2016

Named "Best Place to Work in Money Management" by Pensions & Investments in 2013, 2014, 2016, 2017, 2018, 2019, 2020, & 2022

Locations

Our headquarters and global office locations

Headquarters

Pennsylvania, USA - Serving as the headquarters, responsible for business and client services in the US region.

Regional Offices

London, United Kingdom - Managing investments and client relations in the European market.

Regional Offices

Sydney, Australia - Providing financial services and consulting for clients in the Asia-Pacific region.

Regional Offices

Singapore - Acting as a key office in Southeast Asia, supporting regional business development and investment management.

Our Culture Is Built on Relationships

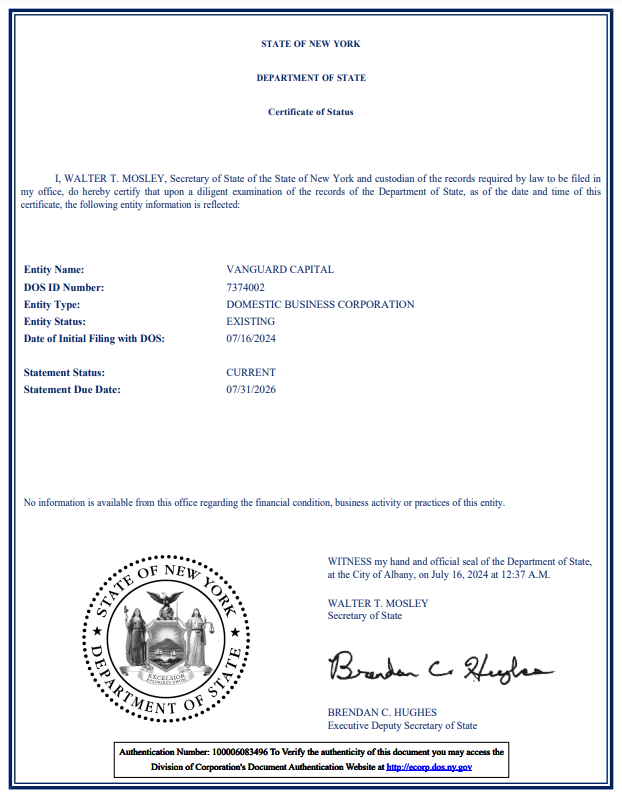

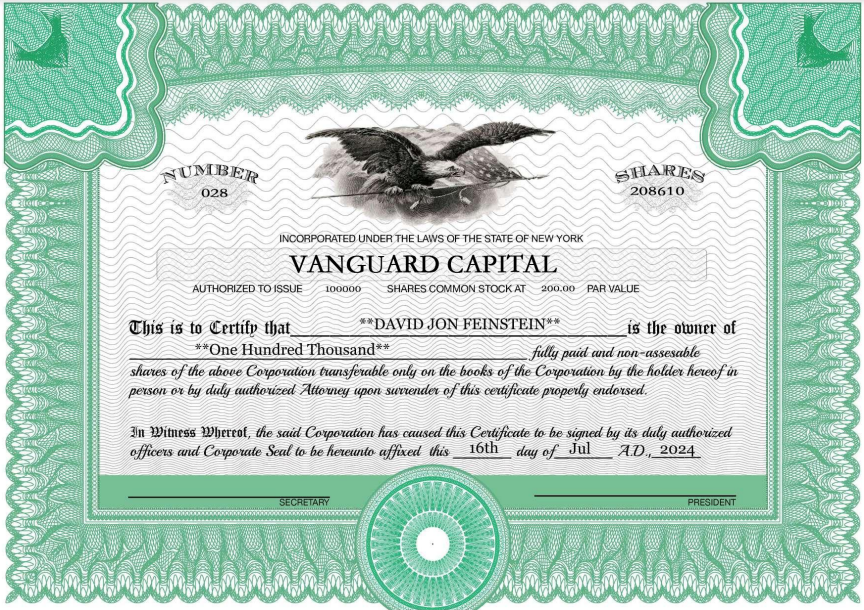

All investments carry risks, including the potential loss of principal. In portfolio management, strategies like diversification, asset allocation, and rebalancing cannot guarantee profits or prevent losses. No investment strategy can ensure achievement of its objectives. Capital Pulse Financial Corporation is not a law firm and does not provide legal advice to clients. All estate planning document preparation and other legal counsel are provided through Advanced Services Law Group, Inc.CapitalPulse Financial Corporation Ltd. is headquartered in the United States. CapitalPulse and Vanguard are partners, with Vanguard being regulated by the SEC, providing a guarantee that ensures the platform is safe and reliable. Many employees at CapitalPulse Financial Corporation Ltd.'s offices worldwide hold CFP® certification marks, CERTIFIED FINANCIAL PLANNER™ certification marks, and the CFP® certification marks with plaque design. These marks are authorized for use by individuals who have successfully met the initial and ongoing certification requirements of the CFP Board. CFA® and Chartered Financial Analyst® are registered trademarks owned by the CFA Institute.